Buying your first home is one of the most exciting yet daunting milestones in life. In Singapore, the process can seem overwhelming, but with the right guidance, it can be a smooth and rewarding experience. This guide will walk you through every step, from understanding your budget to collecting the keys to your new home. Let’s get started!

Step 1: Determine Your Budget

Before you start house hunting, it’s crucial to know how much you can afford. Here’s how to calculate your budget:

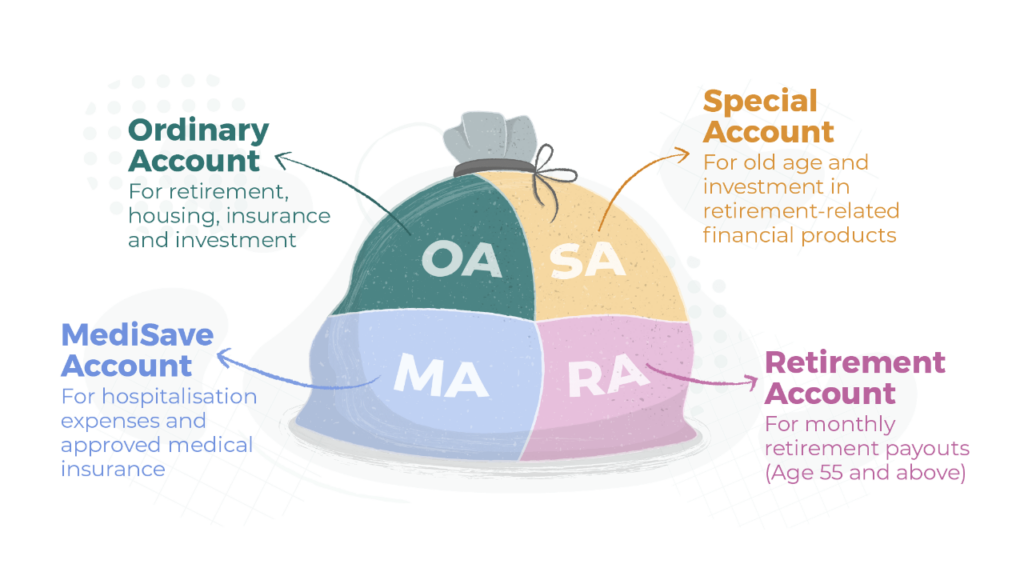

- Calculate Your Total Savings:

- Include your CPF Ordinary Account (OA) savings, cash savings, and any other funds.

- Check Your Loan Eligibility:

- Use the Total Debt Servicing Ratio (TDSR) to determine how much you can borrow. Banks typically allow up to 55% of your monthly income for loan repayments.

- Factor in Additional Costs:

- Include costs like stamp duty, legal fees, renovation, and furniture.

Step 2: Choose Between HDB and Private Property

Decide whether you want to buy an HDB flat or a private property. Here’s a quick comparison:

| Criteria | HDB Flat | Private Property |

|---|---|---|

| Price | More affordable | Higher price point |

| Eligibility | Must meet HDB eligibility conditions | Open to all buyers |

| Grants | Eligible for government grants | No grants available |

| Location | Mostly in suburban areas | Prime and central locations |

| Amenities | Community-focused amenities | Premium facilities (e.g., pools, gyms) |

Step 3: Understand CPF Usage

Your CPF Ordinary Account (OA) can be used for the downpayment, monthly loan repayments, and other housing-related expenses. Here’s how it works:

- Downpayment:

- For HDB flats: Up to 20% of the purchase price can be paid using CPF OA savings.

- For private properties: Up to 25% of the purchase price can be paid using CPF OA savings.

- Monthly Loan Repayments:

- CPF OA savings can be used to pay for your monthly mortgage installments.

- Additional Housing Grants:

- First-time buyers may qualify for grants like the Enhanced CPF Housing Grant (EHG) and Proximity Housing Grant (PHG).

Step 4: Explore Housing Loans

There are two main types of housing loans in Singapore:

- HDB Concessionary Loan:

- Available only for HDB flats.

- Interest rate: 2.6% per annum.

- Loan-to-Value (LTV) limit: Up to 80% of the purchase price.

- Bank Loan:

- Available for both HDB flats and private properties.

- Interest rate: Typically 1.5%–2.5% per annum (floating rate).

- LTV limit: Up to 75% of the purchase price.

Step 5: Apply for Grants (If Eligible)

First-time buyers can benefit from various government grants:

- Enhanced CPF Housing Grant (EHG):

- Up to $80,000 for eligible first-time buyers.

- Income ceiling: 9,000(forsingles)or9,000(forsingles)or18,000 (for families).

- Proximity Housing Grant (PHG):

- Up to $30,000 for buying a resale flat near your parents or children.

- Family Grant:

- Up to $50,000 for families buying a resale flat.

Step 6: Start House Hunting

Now that you’ve sorted your finances, it’s time to find your dream home. Here’s how:

- HDB Flats:

- Browse the HDB Resale Portal or attend open house viewings.

- Consider factors like location, proximity to MRT stations, schools, and amenities.

- Private Properties:

- Work with a trusted real estate agent to explore condos or landed properties.

- Check out property portals like PropertyGuru or 99.co.

Step 7: Make an Offer and Negotiate

Once you’ve found a property you love, it’s time to make an offer:

- HDB Resale Flats:

- Submit a Request for Value (RFV) to determine the flat’s market value.

- Negotiate the price with the seller.

- Private Properties:

- Submit an Option to Purchase (OTP) and pay a 1% option fee.

- Negotiate the price and terms with the seller.

Step 8: Complete the Legal Process

After agreeing on the price, you’ll need to complete the legal formalities:

- Engage a Lawyer:

- Hire a lawyer to handle the legal paperwork and conveyancing.

- Pay the Downpayment:

- Use your CPF OA savings or cash to pay the downpayment.

- Sign the Agreement:

- Sign the Sale and Purchase Agreement (for HDB) or the Option to Purchase (for private properties).

Step 9: Collect the Keys

Once all payments and paperwork are completed, it’s time to collect the keys to your new home!

- HDB Flats:

- Attend the key collection appointment at the HDB branch.

- Private Properties:

- Arrange for key collection with the seller or developer.

Step 10: Avoid Common Pitfalls

Here are some common mistakes to avoid as a first-time homebuyer:

- Overstretching Your Budget:

- Stick to your budget and avoid taking on too much debt.

- Ignoring Additional Costs:

- Factor in costs like renovation, furniture, and maintenance fees.

- Not Researching the Neighborhood:

- Visit the neighborhood at different times to assess noise levels, traffic, and amenities.

- Skipping the Home Inspection:

- Always inspect the property for defects or issues before committing.

Conclusion

Buying your first home in Singapore doesn’t have to be stressful. By following this step-by-step guide, you’ll be well-prepared to navigate the process with confidence. Remember, the key to a successful purchase is thorough research, careful planning, and seeking professional advice when needed.

“Ready to take the first step toward owning your dream home?